Calculate depreciation expense for tax purposes

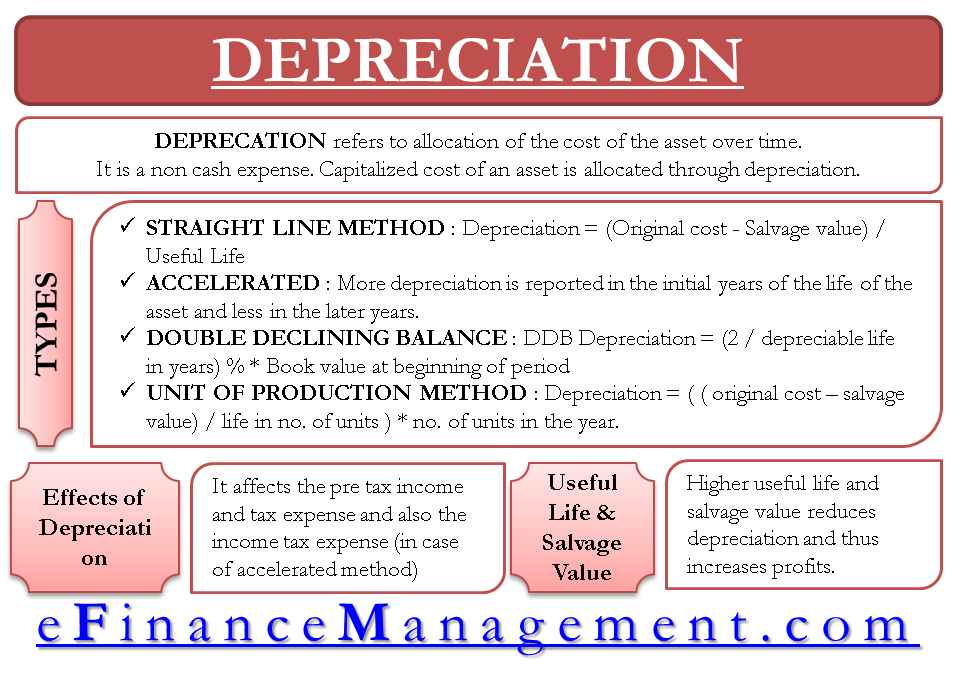

Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. The formula for this is cost of asset minus salvage value divided by useful life.

Depreciation What It Is And How To Use It Cropwatch University Of Nebraska Lincoln

Ad Mark Your Business Expenses As Billable Pull Them Onto an Invoice For Your Client.

. Asset cost - salvage valueestimated units over assets life x actual units made. Basis essentially means sunk cost. The cost of the asset asset basis including costs for buying the asset shipping setup and.

Say a company spent 50000 for equipment for long-term use in its operations. 25000 - 50050000 x 5000 2450. But if you use the actual expense method the amount you can write off as depreciation is your basis in the vehicle.

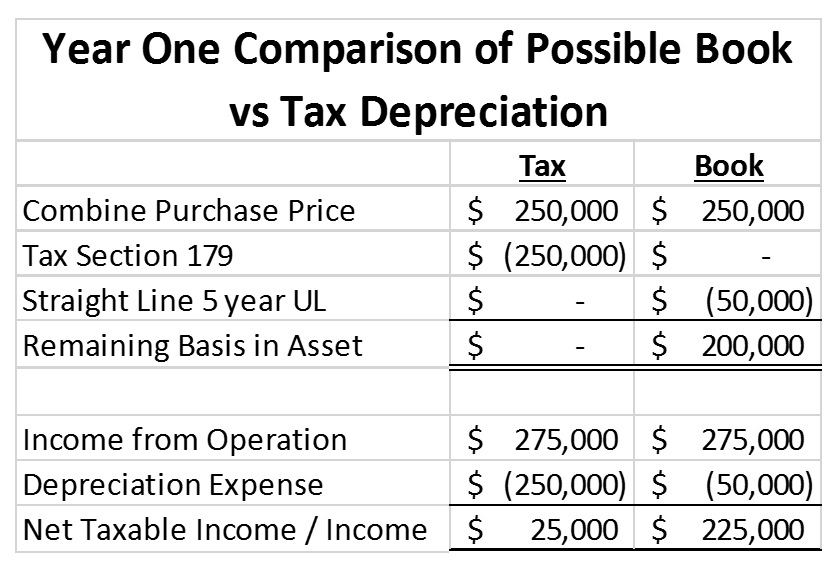

Currently the IRS allows up to 1080000 of depreciation expense in one year for an asset and up to 2700000 for the cumulative depreciation expense for all tangible assets. Solutions for Chapter 18 Problem 7SC. The straight-line method is the most widely used and is quick and easy.

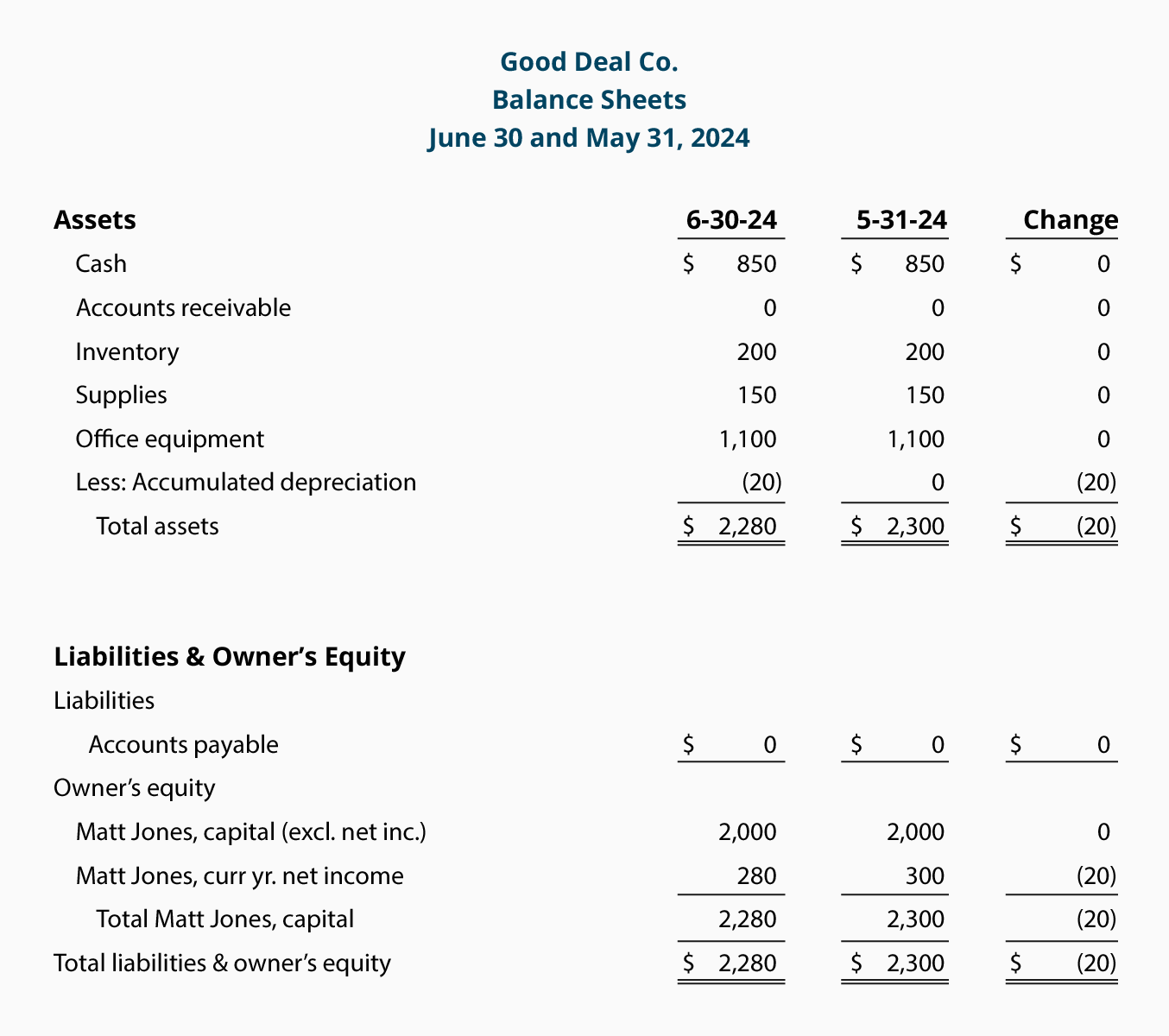

This is the most the company can claim as depreciation for tax and sale purposes. The resulting depreciation expense is deducted from the pre-tax net income generated by the property. The depreciable amount is 9000.

Your basis in the property the recovery period and the. To calculate depreciation the value of the building is divided by 275 years. The Platform That Drives Efficiencies.

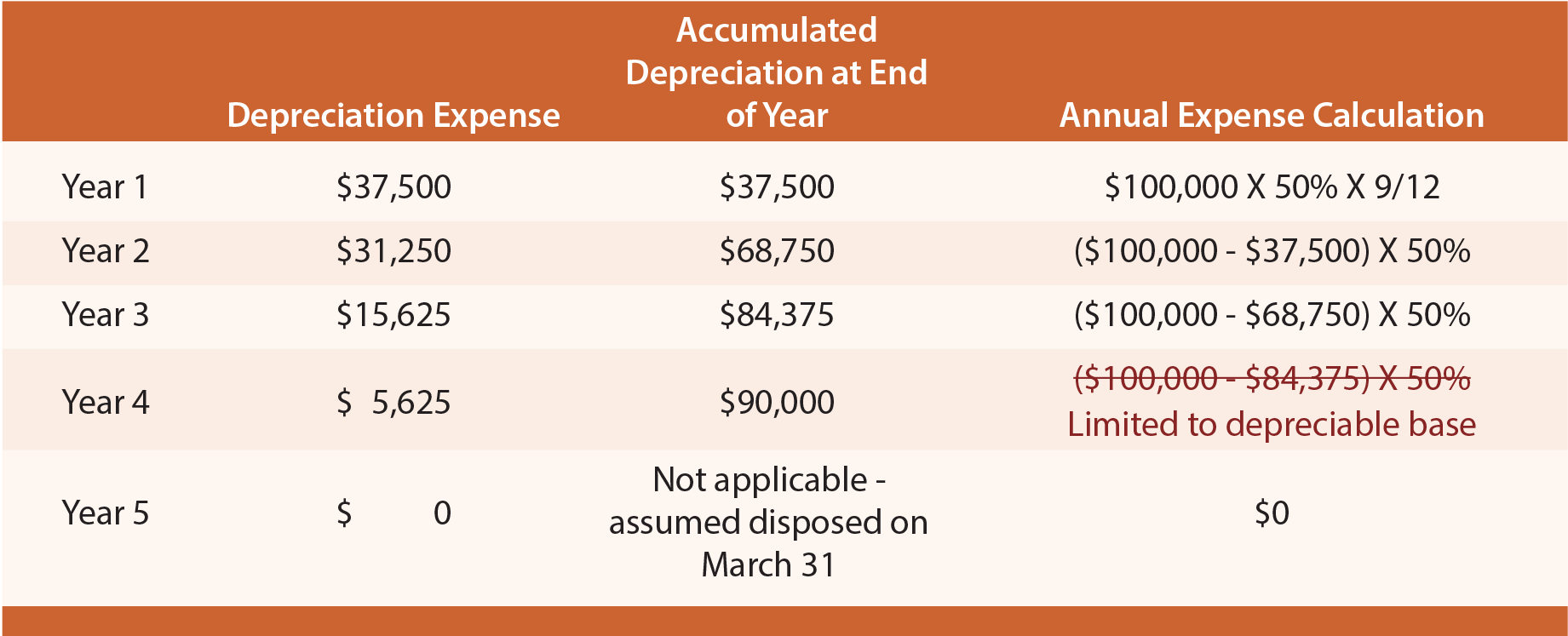

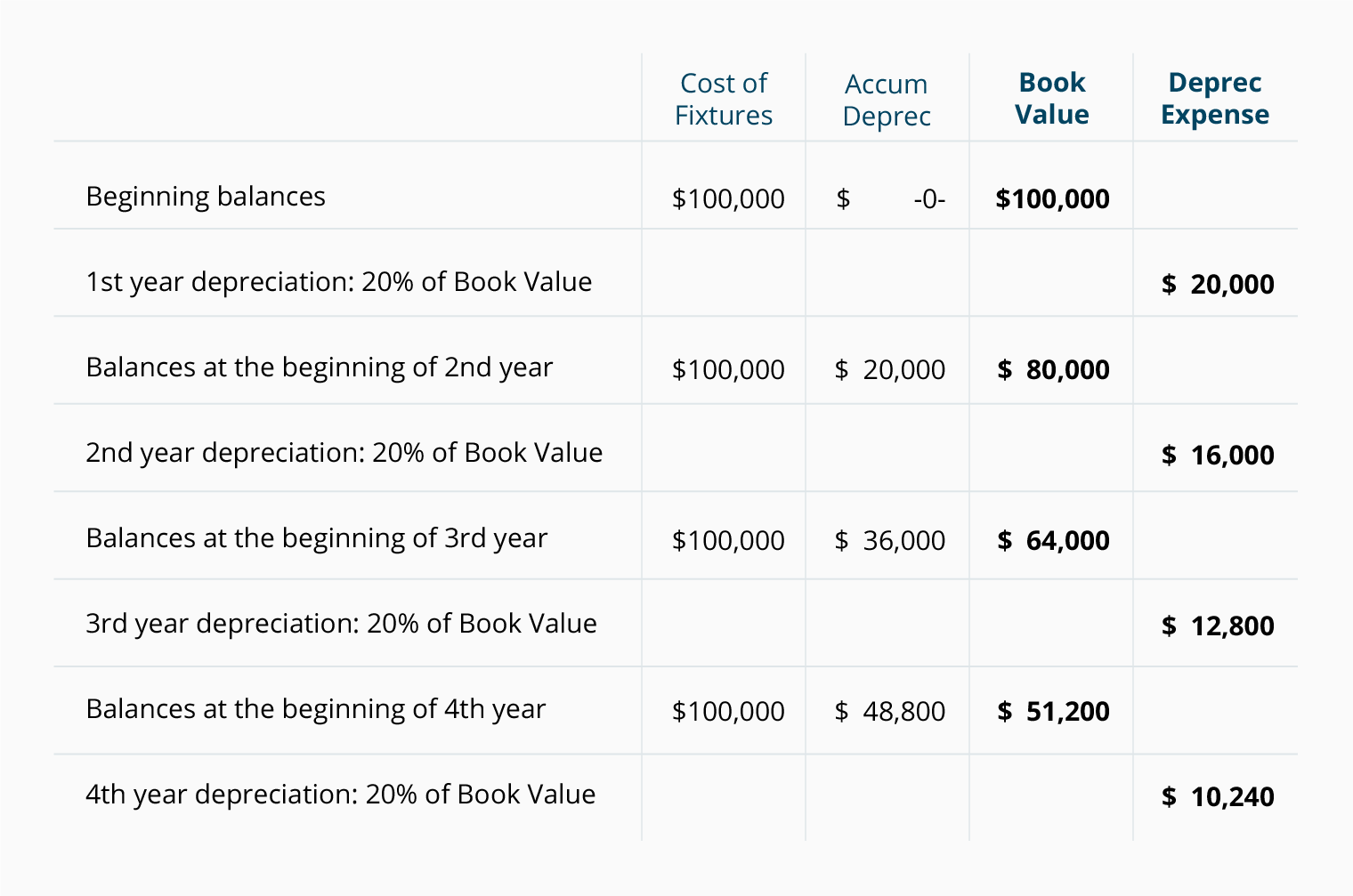

Year 1 20 of the cost. In this case it is 15 years or 1 2 3 4 5. Years 4 and 5 1152.

To calculate the depreciation value per year first calculate the sum of the years digits. There are many methods of calculating depreciation but there are two main systems straight line and reducing balance. How To Calculate Depreciation.

How to Calculate Depreciation Three factors determine the amount of depreciation you can deduct each year. Calculate the depreciation expense for tax purposes using MACRS for each asset. Your adjusted basis in the stock of the corporation is 50000.

You use one half of your apartment. Our Users Save Over 6 Hours a Month On Expense Tracking and Management. It equals total depreciation 45000 divided by useful life 15 years or 3000 per year.

This calculator calculates depreciation by a formula. In this video Alexander Efros MBA EA CPA CFP from Efros Financial explains the process of calculating depreciation for income tax purposes Part 1 of 2. If a careful inventory of these appliances is taken and thoroughly documented to support the value of those appliances this could set aside a sizeable value to depreciate faster thereby.

Use Figure on page 358 to determine the proper life and rate for each. According to the general rule you calculate depreciation over a six-year span as follows. You figure your share of the cooperative housing corporations depreciation to be 30000.

It assumes MM mid month convention and SL straight-line depreciation. To calculate depreciation you need to know. The IRS also allows calculation of depreciation through.

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods Principlesofaccounting Com

Depreciation Expense Depreciation Expense Accountingcoach

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Tax Shield Formula And Calculator Excel Template

How To Use Rental Property Depreciation To Your Advantage

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

How To Calculate Depreciation Expense

How To Calculate Depreciation Expense For Business

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Definition Formula Calculation

Depreciation Definition Types Of Its Methods With Impact On Net Income

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Tax Shield Formula And Calculator Excel Template

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker